How Manufacturers of Interior Lighting Should Play the Specification Game

The rapidly changing and complex B2B marketplace today makes it difficult for manufacturers to know where to focus their marketing efforts. Complexity also makes measuring actual brand preference within the design market difficult.

The rapidly changing and complex B2B marketplace today makes it difficult for manufacturers to know where to focus their marketing efforts. Complexity also makes measuring actual brand preference within the design market difficult.

Take interior lighting products. Architects and interior designers have many choices when it comes to the brand and lighting options. It used to be enough to be a part of a firm’s “short list.” Today it might be better to be named as the “basis of design.” Better yet, becoming the brand named in a light fixture schedule or required with no substitutions is probably the best.

The way manufacturers become “the brand” required is through building stronger relationships with architects/designers. How does that work?

The Most Important “P” in the 4 “Ps” of Marketing is Silent

Traditional marketing thought suggests there are 4Ps in a Marketing Mix representing four broad levels of interconnected but independent variables. They are: Product, Price, Promotion, and Place.

This thinking has been entirely wrong because it neglected the silent “P” – Problem. As the pronunciation of some words in English have silent letters you do not pronounce (i.e., the silent ‘d’ is in the word WEDNESDAY), the silent word in the marketing 4 Ps is PROBLEM — so silent, everyone forgot about it.

Many manufactures work hard to get their brand in an architect’s specification. They try different tactics. Some hire specialized firms that call on architects. Others send out projects on spreadsheets to their rep organizations to “pursue.” They start adjusting the 4 “Ps” when things are not working. They play with their price, or they do a promotion, or they “tweak” their product.

The result, however, is that architects and designers become inundated with information. Like all of us, they quickly realize there is only so much time and there is never enough of it.

Time, then, becomes the currency, and deciding how to spend that time on achieving a specification preference becomes the objective. But if you forget the silent “P,” you really will regularly mis-calculate on what you have to do to win in the specification game.

The thing that governs the time of an architect or designer is the problem they happen to be trying to solve – NOT a product trying to be pitched to them. In other words, it’s the PROBLEM, not the PRODUCT.

So how do you gain the time with the architect or designer to gain specification preference? How do you find the problems they are facing?

Solve Their Problems.

Manufacturers depend on their sales organizations to find out about the problems designers face. But that rarely works because the reps are too busy selling and trying to force-fit the product into the thinking of the designer.

Or, as mentioned, manufacturers hire mercenaries, but the results will be the same.

Unless that presentation and pitch solve a problem the designer is having at that time, nothing happens.

Elmer G. Leterman, one of the greatest salespeople who lived, wrote a book (now virtually out of print) called, “The Sale Begins When the Customer Says No” offered the secret:

“The main – in fact, the exclusive—reason for a sale is because something is urgently required by the buyer…The rise of total closings to a new high for the month or year is most desirable. It is secondary, however, to the needs of the person on the other side of the table.”

Therefore, using either your own sales representatives or hired mercenaries doesn’t matter: knowing the problems of your target is really the tell.

Specification Time

Architects and designers do not change or review their specs often. In research conducted and published by Architect Magazine titled The Truth About Specification[1], architects find the process of writing and preparing specs somewhat routine and boring.

Consequently, many times architects re-use or revise existing specifications In fact, the research found that only 26% write specs from scratch and 57% end up using specs from a previous project—sometimes using the spec with no changes.

What that means is the specifications may, in fact, not be solving the problems they are facing NOW.

Furthermore, that routine makes it very difficult for a “new” manufacturer or an existing manufacturer with a new product to penetrate an architect’s specifications — unless the pitch is addressing the problem the designer is currently having.

The article also indicated most architects (approximately 70%) use products and suppliers who they have a relationship with. Often even before the specification is prepared, the architect has already decided on the products they will be using.

So building long term solid relationships with architects is more important today for getting a brand specified or purchased. And the only way to do that is to solve their problems.

To stimulate competitive bids/pricing, architect’s specifications often must contain a list of alternative brands. In most specifications for commercial projects, the specs will contain an average of 5 or more manufacturers. This allows the contractor the ability to “substitute” brands to remain competitive.

Furthermore, the manufacturer with the product that can solve the architect’s problem can utilize the existing spec to CHANGE it! The architect can be shown why the product is BETTER than the specified ones because it SOLVES the problem.

Besides, just because you are “on” the list, it does not mean your product will be purchased. When a brand is among the options presented, there may be a “better” chance at being purchased but your chance could be 1 in 5 or more. With options, contractors may choose the brand that is least expensive or readily available or simply “easier” for them to install. So how do manufacturers increase the probability that their brand will be purchased? Relationships are key.

Build Relationships by Solving their Problem

Manufacturers need to start to develop relationships with architects to provide them with the information they need to make better product selections. First it is important to understand what factors have the most impact on a designers’ brand selection.

Brand selection can vary based on the type of product and project, and often some factors are more critical than others. For interior lighting product,s the demand for the right “look” or the aesthetics needs to be balanced with other needs of the project like functionality, energy savings, or safety.

Sometimes there are also other project objectives or building codes that can impact a designer’s selection on the brand or style lighting. All of these “variables” are problems that the architect or designer is having that a manufactured product can solve.

For example, depending on the type of project, there may be additional requirements for security or energy concerns they are facing. Does your product address those problems?

Evaluating how interior lighting products are specified and what problems those products are solving is essential to helping manufacturers build their brand presence and relationship with architects and designers.

By tracking the frequency and placement of a brand in project specifications, manufacturers can begin to learn how well their brand is penetrating the design market. The specifications actually tell you the type of problems they are facing. What manufacturers should use specification analysis to do is uncover the products specified, figure out the problems those products solve, and then talk to architects about their current problems. In addition, specification analysis gives manufacturers a way to evaluate their position in relationship to competitors.

Spec Analysis is a Way to Evaluate a Brand’s Position with Designers

A comprehensive Accountability Information Management, Inc. (AIM) Architects’ Brand Preference Study revealed just how competitive the interior lighting market is. In this unaided blind brand preference study, architects and designers were asked to list their top three brands of interior lighting products.

There were over 70 brands or companies mentioned by designers that were “involved” with the specification of these products. Although the list of specific brands shifts over time, the numerous choices designers have to choose from still holds true. Designers have lots of brand choices when it comes to interior lighting products.

To help manufacturers evaluate their brand position in the marketplace, it is important to understand more about an architect’s level of involvement when specifying interior lighting products. How much control or influence does the architect or designer have on selecting a particular brand of lighting?

Looking at interior lighting products, the degree to which architects are involved in specifying a specific brand or manufacturer can vary. Today architects and designers often need to balance the project budget with specific design goals; but, other factors like the type of project, the location of the product within the facility or the need for energy efficiency or protection from vandalism could impact the interior lighting decisions.

For example, in a retail or high traffic public facility with many lighting requirements, the type or brand of lighting may be influenced by the need for added security or occupant needs.

In AIM’s Architect’s Brand Preference research, only 23% of the architects surveyed indicated that they were not involved in selecting and specifying the brand interior lighting products.

In addition, 21% indicated they did not have any type of brand preference—an increase from 13% with “no preference” in a previous study.

While architects may indicate they have “no preference,” they are, in fact, involved in specifying and recommending interior lighting products. However, due to the complexity of commercial projects, architects may delegate the brand selection to the interior designer or “others” in the specification path.

Many design firms today maintain a list of “approved” brands that meet their performance and quality requirements. If a manufacturer is not on “the list,” the chance of being in a specification are limited. It is becoming increasingly important for manufacturers to expose and educate designers on their product features, benefits and other services they offer the market that will solve the real problems they are facing.

Becoming a brand on the architect’s preferred list of brands is key to impacting a brand’s position in the specifications. To be on a firm’s list of approved interior lighting brands, a manufacturer needs to provide more than just a quality product. They need to have a history of top performance, offer premiere service and local support for their brand. They should in the end SOLVE THE PROBLEM.

What should lighting manufacturers do to enhance brand selection and preference? How can manufacturers convert “no preference” answers into specifications and recommendations for their brands? These are important questions.

Impacting Brand Specification with the Basis of Design

To answer these questions, consider what we know about specifications. The key to gaining ground in specifications is to become part of the “basis of design.”[2] This means that the architect or designer is calling out a specific brand that is used to meet the objectives of the project, and you will become the basis of design if your product solves a problem!

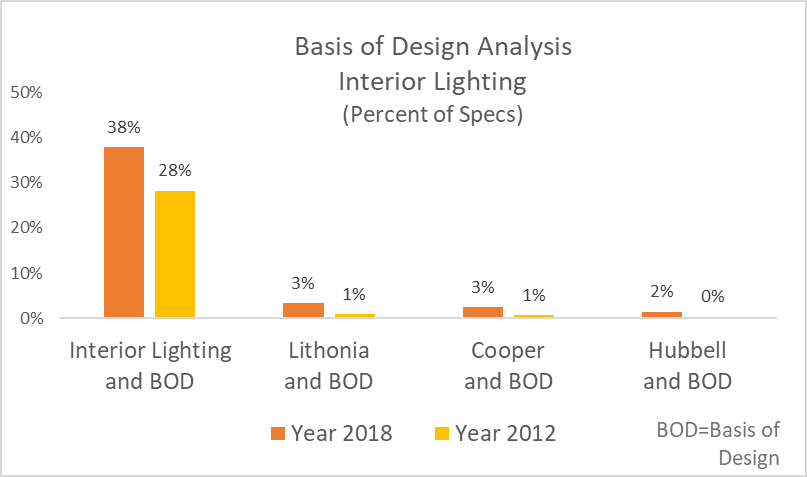

To learn more about how often “basis of design” is used in interior lighting specs, we used ConstructConnect™, (https://www.constructconnect.com/), an online construction database, to get a better sense of how interior lighting products are specified. By searching the project interior lighting specifications for “interior lighting projects with Basis of Design,” in specific years, we can see how the specification for “basis of design” and specific brands has evolved.

Only 38% of projects in 2018 with an interior lighting specification also included a brand as the “basis of design.” However, this has increased since 2012 where “basis of design” was specified in only 28% of the interior lighting specifications.

Since there are many brands that are involved in delivering interior lighting products to the market, this type of spec analysis can show manufacturers how often their brand is specified as the “basis of design” and if it has shifted over a specific period of time. Examining the kinds of products specified, moreover, will help you understand the type of problems these architects may be facing.

The market is constantly changing and it is important for a manufacturer to continuously review their position in architects’ specifications. While a manufacturer cannot always be sure that they are on a firm’s “preferred” list, they can evaluate how often their brand appears in the specifications and measure how often they are the “basis of the design” or appear in the lighting schedule. Further, they can study the types of products being specified to help understand the problems faced by architects.

Indeed, calling up a dozen of the architects in these projects will produce a completely new way of thinking about the products needed to solve their problems.

Such research can be done on the other product categories or on specific brands based on the manufacturer’s needs. AIM can design a spec analysis to meet a client’s objectives and look at a particular brand/manufacturer, by territory, competitors, project type, location or by spec area/schedule. Let us know where your interests are and how we can help. Thank you.

__________________________________

[1] The Truth About Specification, by John Schneidawind, AIA highlights key findings on an AIA survey of 330 architects on how they select and specify building materials for commercial projects. The article stresses the importance of an architect’s relationship with building product manufacturers and report that 60% of the time the architect already knows which materials an architect is going to use.

[2]USlegal.com defines it as “Basis of design is a term used in engineering, which typically consists of text paragraphs, preliminary drawings, equipment lists, etc. Well-defined requirements consist of a set of statements that could form the basis of inspection and test acceptance criteria. The basis of design documentation and the specification identify how the design provides the performance and operational requirements of the project and its systems.”