Open Showers Trend in 2020 Offers Opportunity to Increase Brand Exposure in Shower Enclosure Specifications

According to an article by Builder-Online, a popular design-build site,[1] open bathrooms with walk in showers will continue to be the trend for 2020. Open showers not only give the appearance of more space, but they offer more functionality and easy access.

In 2019 Houzz Bathroom research report[2], designers surveyed indicated size matters. According to the report, 83% of homeowners upgrade the shower when they remodel their bathroom with over half (54%) increasing the size of the shower.

The continued bathroom trend for 2020 will be to create “enclosed shower areas,” giving users the feeling of being in a spa. Walk in showers with compartmental shower doors of frameless glass will also continue to be part of this trend.

That spells tremendous opportunity for manufacturers of shower enclosures.

To take advantage of these 2020 trends for larger enclosed shower areas, manufacturers of shower doors and enclosures should take time to review and strengthen their position in designer’s specifications.

Shower Enclosure Market Potential

The new construction and bathroom remodeling market is large and is predicted to continue to grow. According to a comprehensive market study by the National Kitchen and Bath Association (NKBA)[3] in 2017 the market spent $78 billion on bathroom products, with 63% attributed to bathroom remodeling projects and the remainder from new construction.

In addition, the Global Shower Enclosure and Cubicles Market 2017-2021[4] detailed report indicates that the shower enclosure market is predicted to grow approximately 5% per year to 2021. The report states the demand for shower enclosures is driven by the high level of consumers participating in bathroom renovations.

Understanding & Maximizing the Specs

In order to increase a shower enclosure manufacturer’s chances of being specified, selected and ultimately purchased, it is important to understand how the specification process works and learn more about how architects and designers are actually specifying shower enclosure products.

To do that, AIM used the ConstructConnect™ database of construction to look at 2019 specifications. At the time of the report, there were 45,485 projects in the planning stages (updated in the past 12 months) within the U.S. that had specifications. Of these projects only 7% or 181 projects had a plumbing specification for shower enclosures.

This indicates that this is a narrow market, making it even more critical for shower enclosure manufacturers to evaluate and strengthen their position in the designer’s spec.

Many manufactures work hard to get their brand in the designer’s specification and to be included in the list of approved brands. For many manufacturers, getting a product into the specification can be a difficult task. Architects and designers do not change or review their specs often. In research conducted and published by Architect Magazine titled The Truth About Specification[5], many times architects re-use or revise existing specifications. In addition, there are many large national established brands in the shower enclosure market which makes it almost impossible for new brands to penetrate the market.

In “shower enclosures,” Sweets represents 70 manufacturers. ThomasNet says there are 71. This is a competitive set of companies!

Looking closer at the shower enclosure specifications, there is a wide dispersion of how shower enclosure brands appear. Several manufacturers that can be used might be listed, or a detailed description and specs on the required enclosure without a brand or even just a model number might be provided.

For example, in some specifications the architect requires a specific brand which is used as the “basis of design” but indicates the owner can approve an equal product. Other specifications indicate the “basis of design” product can be found on the drawings and also lists comparable products that can replace the basis of design product. Here are some examples.

Interestingly, four companies from the A specification above are not found in Sweets, while none of them are found in ThomasNet.

Brand Preference

Accountability Information Management’s (AIM) Brand Preference Study revealed just how competitive the shower enclosure market is.

In this unaided blind brand preference study, architects and designers were asked to list their top three brands of shower enclosures. There were over 20 different brands or companies mentioned by architects in AIM’s proprietary research with architects that were “involved” with the specification of these products. Although the list of specific brands has no doubt shifted over time, the numerous choices designers can choose from still holds true.

Designers have lots of brand choices when it comes to shower enclosures. In fact, the recent search of specs for shower enclosures in the ConstructConnect™ database showed there were often more than 5 different shower brands specified in a project, with the option to mix and match brands. Oftentimes, the spec would say the brand of shower specified could be replaced with an equal brand approved by the owner.

Using Spec Analysis to Boost Brand’s Market Position

To help manufacturers evaluate their brand position in the marketplace, it is important to first understand more about an architect’s level of involvement when specifying shower enclosures. How much control or influence does the architect or designer have on selecting a particular brand of shower?

The architects’ involvement in specifying a specific brand or manufacturer of shower enclosure can vary based on the project type, the owner’s requirements and the architect’s design preferences.

In AIM’s Architect’s Brand Preference research, only 33% of architects surveyed indicated that they were involved in selecting and specifying the brand of shower enclosure. This was down from an earlier study where 55% of architects surveyed indicated they were involved in making brand decisions for showers. Does that mean someone else (i.e., engineer, interior designer) is doing the specifications?

In addition, of those that were involved, 42% indicated they did not have brand preference. This was a major increase since previous research which indicated only 6% had no brand preference.

Maybe some architects do not distinguish the difference of one brand over another? Or, is the choice being delegated to someone else in the value chain as mentioned, or simply, not relevant and left to the contractor?

While architects may indicate they have “no preference,” they are, in fact, involved in specifying and recommending shower enclosures. The architect will weigh in on the type of look or style they want to achieve besides performance criteria.

However, due to the abundance of brand options, architects may delegate the brand selection to “others” in the specification path (i.e., the interior designer). Many design firms today maintain a list of “approved” brands that have met specific performance and quality requirements. If a manufacturer is not on “the list,” the chance of being in a specification are limited. It is becoming increasingly important for manufacturers to expose and educate architects on their product features, benefits and other services they offer the market.

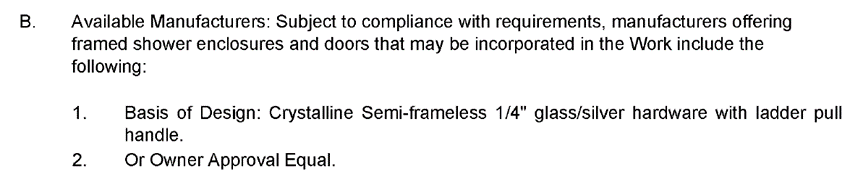

In AIM’s Brand Preference research, overall, most architects indicated that brand was extremely important to their selection of a particular shower enclosure—rating brand 3.92 in importance where one equals not very important and 5 equals extremely important.

In fact, verbatim comments in AIM’s research indicated that one architect used one brand exclusively because they were proven over time to be durable and the manufacturer also provided a variety of selection. Other architects used brands that provided a certain look or met the specific project goals.

Becoming a brand on the architect’s preferred list of brands is key to impacting a brand’s position in the specifications. To be on a firm’s list of approved shower providers, a manufacturer needs to provide more than just a quality product. They need to have a history of top performance, offer premiere service and local support for their brand. What can manufacturers of shower enclosures do to enhance brand selection and preference? How can manufacturers convert “no preference” answers into specifications and recommendations for their brands? These are important questions.

Impacting Brand Specification with the Basis of Design

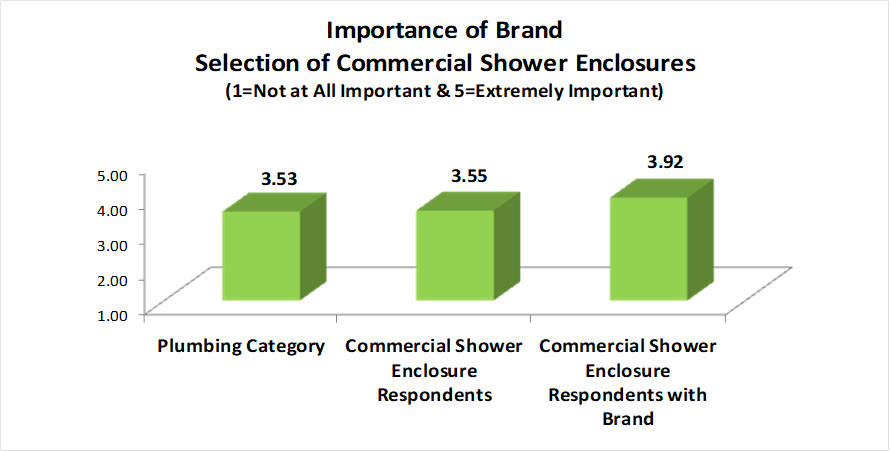

To answer these questions, consider what we know about specifications. The key to gaining ground in specifications is to become part of the “basis of design”[6] or be listed as the brand of choice with no substitutions. The “basis of design” means that the architect or designer is calling out a specific brand that is used to meet the objectives of the project. To learn more about how often “basis of design” is used in shower enclosure specs, we used ConstructConnect™, an online construction database, to get a better sense of how shower enclosures are specified. By searching the projects for “shower enclosure or individual shower with Basis of Design” in specific years, we can see how the specification for “basis of design” and specific brands has changed.

Only a quarter or 25% of U.S. projects in 2019 with a shower enclosure specification also included a brand as the “basis of design.” In fact, this has decreased slightly since 2012 where “basis of design” was specified in 28% of the shower specifications. This analysis also indicates that while less than 50% of projects with a shower specification have a “basis of design” spec, there are specific brands that consistently appear as the basis of design.

Since there are a variety of different brands that are involved in providing shower enclosures to the market, this type of spec analysis can show manufacturers how often their brand is specified as the “basis of design” and if it has shifted over a specific period of time.

Since the market is constantly changing as new and existing manufacturers introduce new products to the market, it is important for a manufacturer to continuously review their position in the project specifications. While a manufacturer cannot always be sure that they are on a firm’s “preferred” list, they can evaluate how often their brand appears in the specifications and measure how often they are the “basis of the design” or appear in the project shower enclosure schedules. If a brand is found in the specifications and is the “basis of design”, they certainly are going to be on the list of “preferred” brands.

The specification analysis also indicates that in some specs a specific brand can be called out. To avoid being replaced by a “less expensive” or a “comparable” product, shower enclosure manufacturers may want to strive to be specified as the brand with “no substitutions”. This requires a “contact strategy” with the architectural firms in the market.

Let’s take a “sneak peek” on how a strategy might look.

Sneak Peek at Strategy

Here is a sample of how you might approach this type of analysis for your marketing purposes if you are a shower enclosure manufacturer.

There are currently 614 projects in the construction database ConstructConnect in the planning stage with “shower enclosures” specified. There are actually over 6.800 projects, but we selected the planning stage for our sneak peek to demonstrate what we mean by specification analysis to help your marketing strategy.

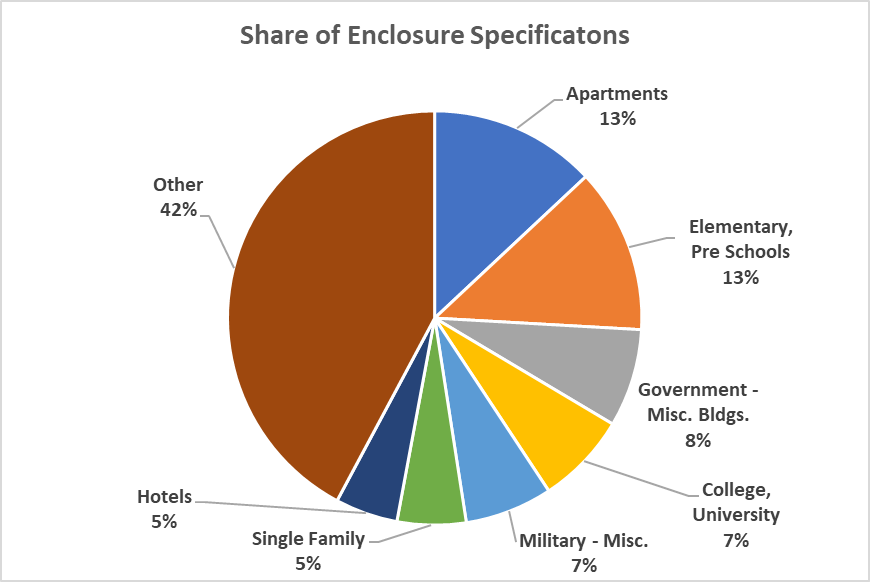

This next chart shows the “share” of specifications by category in these 614 planning projects.

Note that Apartments is the top category, tied with Elementary and Pre Schools. Other categories which is almost half of the pie chart include Fire And Police Stations , High Schools, Nursing Homes and Hospitals, Clinics to mention a few.

Targeting

The object of your strategy is to identify the architects who specify shower enclosures. There are 70 architects who are specifying the apartment projects in the prior pie chart. They can, through specification analysis, be identified, targeted, and contacted. But what do you tell them? That you have greatest enclosures in the world? Every shower enclosure manufacturer says that!

Besides, as pointed out in this article, they already have a “short list,” and if you are not on it, the road to specification will be long.

Contact strategies have to be about differentiation, and differentiation starts with knowledge – self knowledge about a company’s strengths and weaknesses. What if you could identify which manufacturer is being specified…and identify which architectural firm specifies them? Then, what if you could target the company with YOUR products? If you are a leader[7], what if you identified the other leader you want to attack? Or stop the upstart newcomer who is entering the marketing?

And in both cases, what if you could identify the architects associated with those projects in order to convince them of your value over your competitors?

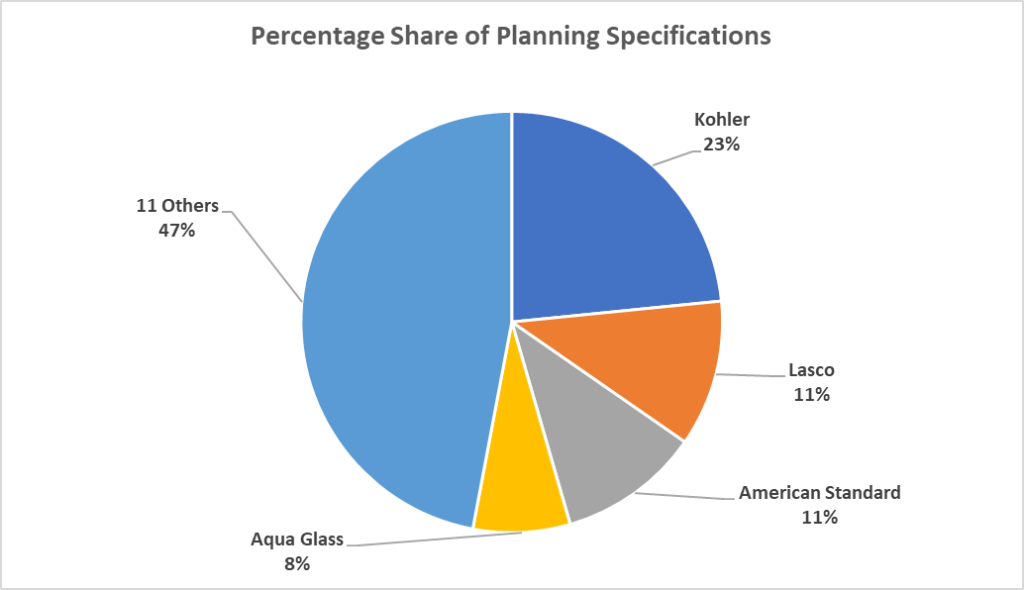

The next chart shows the enclosure manufacturers being specified in the Apartment category in order for you to take those steps.

You can see that the Basis of Design study graph shown earlier holds true: the three companies who dominate basis of design are here, in these specifications. However, another company – Lasco – is a strong contender. But Lasco is simply a “brand.” It’s owned by Aquatic, who also has specifications in the chart (one of the 11 others). Are they a threat? Where does YOUR company stand in this mix?

Now targeting and creating a contact strategy makes more sense, doesn’t it? You actually have many choices.

You can target the 70 architects who are involved in Apartments, for example. Or, you might target one of the manufacturers in the second chart you want to attack and attempt to take share away.

Let’s say you decide on the latter. You can reduce your targets to 13 architects depending on the competitor you select – a much more manageable number.

Here are the architects specifying that competitor (we selected a random competitor for the chart):

- Architecture Incorporated

- Cadco Architects-Engineers Inc.

- Cornerstone Architectural Group

- Delta Engineers, Architects

- E4H Architecture

- Helix Design Group

- KKT Architects, Inc

- NAC Architecture – Spokane Office

- Randall-Paulson Architects Inc.

- Selser Schaefer Architects

- TSHD Architects

- W Design

- WM2A

Now all you have to do is craft a contact strategy, which would involve examining the specifications these firms are writing using enclosures closer. The projects they control – which are valued at $146M – include Government, Medical, Elementary schools, Athletic Buildings, Manufacturing and more. And they all have shower enclosures!

For example, one project – a museum – includes a specification for seven enclosure manufacturers. You might be among them; you might not. Regardless, your strategy if you follow this line of thinking will be the same: to make your product the one that gets installed.

Here’s the problem: in the specification, all seven are listed as “basis of design.” If you are among them, your strategy might be different than if you are not among them. It would be harder if you are not part of the seven, but not impossible.

Let’s say you are one of the seven. Now your task is to prove to the architect you are the one over the other six that should be installed. Maybe a CEU does that. Or, perhaps sales call strategy on the owner of the project. Maybe you do a “value added” project, like conducting a study on other museum projects that included shower enclosures and present it to the architect.

KKT Architects, Inc. ,who happens to be one on this museum project, provides comprehensive architectural, interiors, structural engineering, civil engineering and planning services. It’s a good-sized firm, with many contacts. You need to identify the key one or two and then start that type of conversation.

But say you are NOT one of the seven. How would you proceed?

The same way! CEUs, engagement, personal presentations – the difference is that you have to “introduce” yourself in what’s known as the “cold call.”

And that’s a story for another time.

Keep in mind that this kind of strategy can be done with any product. We’re here to help because we know you don’t have all the time necessary! Let us know how we can do that. Thanks for reading.

____________________________________________________________________

[1] Builder On-line, September 2019, “Top Bathroom Design Trends Expected for 2020” and article by Sebring Design Build, 14 Bathroom Design Trends for 2020.

[2] 2019 U.S. Houzz Bathroom Trends Study, November, 2019, Survey of 1,360 homeowners.

[3] NKBA, 2018-19 Kitchen and Bath Market Outlook, February 2019.

[4] Global Shower Enclosure and Cubicles Market 2017-2021

[5] The Truth About Specification, by John Schneidawind, AIA highlights key findings on an AIA survey of 330 architects on how they select and specify building materials for commercial projects. The article stresses the importance of an architect’s relationship with building product manufacturers and report that 60% of the time the architect already knows which materials an architect is going to use. https://www.architectmagazine.com/aia-architect/aiafeature/the-truth-about-specification_o

[6]USlegal.com defines it as “Basis of design is a term used in engineering, which typically consists of text paragraphs, preliminary drawings, equipment lists, etc. Well-defined requirements consist of a set of statements that could form the basis of inspection and test acceptance criteria. The basis of design documentation and the specification identify how the design provides the performance and operational requirements of the project and its systems.”

[7] We had a client recently tell us that they are not only the leader, but that get three out of four specifications in their product area. We congratulated them, and then did our own research. We found out this assumption was not only false; it was dangerous, because other companies who make what our client made were creeping into the specifications. Aggressive companies – not complacent companies – win the battles. As Jim Mattis said in his book, Call Sign Chaos, “Improvise, adapt, and overcome. Do whatever it takes to carry out the intent.”