Specifying Ceramic Floors – The Battle Between Aesthetics versus Function

Ceramic flooring is one of the oldest types of floor covering and has been used for many years in commercial and residential properties.

Ceramic flooring is one of the oldest types of floor covering and has been used for many years in commercial and residential properties.

The decision on whether to use ceramic flooring verses other types of flooring by architects and designers requires a variety of considerations. According to an article published by Facility Executive[1] titled Choose Flooring Wisely, the facility demands should dictate the flooring choices versus the style or look the architect may be trying to achieve. At the end of the day, the building owner will need to live with the designer’s flooring choices, so function and facility requirements are critical.

But isn’t that what architects should be doing anyway? In How to Align Your Firm with Client Needs[2], Michelle Russo points out that, “When forced to choose, most owners in these sectors the majority of owners want architects to understand the performance of their buildings and the impact on occupants.” In our own proprietary research[3] of facility managers, where we surveyed over 5,000 people who manage commercial, institutional, educational and medical facilities, the majority hire architects and designer because they “understand how we operate, our values, processes, needs, and expectations.” So while previous experience with the project requirements is important, it’s the ability of the architect to relate to the owner/facility manager’s needs – the needs of the building being constructed or managed.

Considerations Involved

In choosing to use ceramic floor tile, designers will first need to consider the volume of foot traffic and other types of rolling traffic the facility requires. In addition, it is important to know how the selection of ceramic tile will impact the building acoustics and the health and safety of the occupants. As with many products used in commercial and residential facilities, the on-going maintenance requirements and cost to purchase and install will have a huge impact on the decisions made about ceramic tile.

According to research conducted by FCNews’[4] the 2018 flooring market sales were $22.98 billion for 19.6 billion square feet of space. The ceramic floor tile sales make up approximately 13% of the sales and square feet. The research also indicates that the price for ceramic tile increased from $.95 per square foot to $1.19. Carpeting/rugs continue to make up the majority of flooring sales—approximately 40%.

One of the biggest pressures ceramic floor tile faces is from luxury vinyl tile (LVT)[5]. The decline or stagnation of the residential building market and the possibility of price increases due to tariffs has also impacted ceramic flooring. The percentage total floor sales that are for ceramic tile has increased slightly since 2003—up approximately 3%. Ceramic floor tile continues to be a strong choice for designers for both function and design.

Not only do commercial projects use ceramic flooring, but in a recent 2019 Houzz Bathroom Trends Study[6] homeowners most often chose ceramic flooring and ceramic wall covering for their bathroom project. Over 50% of the homeowners used ceramic flooring in their new bathroom with 66% indicated using ceramic tile for the shower walls.

Why does Ceramic Flooring Win Over Alternative Flooring Options?

There are many advantages for architects to specify ceramic flooring over other flooring options. Since the primary reason for selecting any type of flooring should take into consideration the ultimate use and function of the facility occupants, designers need consider the overall benefits of using ceramic floor tiles.

One of the biggest benefits of using ceramic tile is because it is environmentally friendly. Ceramic tiles are made from clay, sand or glass and thus considered to be more of a “natural” material. In addition, ceramic tile can be made of recycled content and can be reused. In many parts of the country, the use of ceramic flooring can also reduce energy consumption by keeping commercial and residential projects exposed to high temperatures cooler than other flooring or provide added insulation.

Depending on the project, designers may specify ceramic floor tiles because they are easy to maintain and can be easily disinfected. Ceramic tile is also a good choice for areas with continuous exposure to moisture. Ceramic flooring is most often found in the kitchen, bathroom, entry way and laundry areas. These are all high traffic areas with exposure to moisture. In addition to ceramic tiles resistance to moisture, they are also allergen resistant and more resistant to fire, rot and fading. and a need for cleanliness.

As of this writing, for example, there are 2,468 projects in the planning stage that are using Ceramic Tile in the ConstructConnect™ database of construction. Virtually every kind of building is using this product – from high schools, government offices, hotels and hospitals to fire and police stations, warehouses, medical offices and entertainment centers. 16% of these projects are elementary and college facilities. However, there is no one type of building that dominates ceramic tile’s usage. In terms of project value, apartments hold the largest share of planning projects – but that is only 5% of the overall 2,468 total.

Not only does ceramic tile offer designers clear benefits for long term use and care, they also provide designers with numerous style and design options. Ceramic tiles can come in a variety of different shapes, styles colors and even textures. This give designers almost unlimited options offered by a numerous manufacturer. The question is, does the design community know this?

Every manufacturer faces that question about his product, and manufacturers of ceramic tile are no different. With the many ceramic tile options offered to designers, it is important for manufactures to monitor and evaluate their position in architects and interior designers’ product specification choices. That’s where specification analysis can be of use.

Using Spec Analysis Strengthen a Brand’s Market Position

Many manufactures work hard to get their brand in the designer’s specification and to be included in the list of approved brands. For many manufacturers, getting a product into the specification can be a difficult task. Architects and designers do not change or review their specs often. In research conducted and published by Architect Magazine titled The Truth About Specification[7], many times architects re-use or revise existing specifications. AIM’s Brand Preference Study revealed just how competitive the ceramic floor tile market is. In this unaided blind brand preference study architects and designers were asked to list their top three brands of ceramic tile manufacturers.

There were over 26 different brands or companies mentioned by architects in AIM’s proprietary research with architects that were “involved” with the specification of these products. Although the list of specific brands has no doubt shifted over time, the numerous choices designers have to choose from still holds true.

A brand’s market position is fairly static — unless something disrupts it. In one of AIM’s research reports – What is a Brand – we argued that “Architects are like ranchers when it comes to managing brands that they specify. While the architect may specify a variety of different manufacturers’ brands (beef), it’s the firm’s name on the door that owner hires — not the manufacturer(s). The architectural firm itself becomes the “brand” and the assurance that the products in that specification offer quality and reliability.”

In another post called “What’s Love Got to do with a B2B Brand?” the author argues one of the key ways B2B people get information about products is from their peers! They pointed out that facilities use a variety of methods to find architect/engineer firms to help them with a particular project or service they need. The cited one of our studies that indicated the method used by the higher percent of respondents was recommendations from peers/associates. Facility management people talk to each other on what works or doesn’t work. The reason they use this method is because it provides them with the most honest feedback on a firm’s performance and the quality of work.

Designers do the same thing, and as a result, designers have lots of brand choices when it comes to ceramic floor tile. In fact, the recent search of specs for ceramic floor tile there were often at least 5 brands and sometimes even more than 10 specified.

On some specs, contractors could basically select any brand that complied with the performance requirements outlined in the specification and did not exceed a certain price per square foot.

To help manufacturers evaluate their brand position in the marketplace, it is important to first understand more about an architect’s level of involvement when specifying ceramic floor tile. How much control or influence does the architect or designer have on selecting a particular brand of ceramic tile?

Looking at ceramic floor tile, the architects’ involvement in specifying a specific brand or manufacturer can vary based on the project type, the owner’s requirements and the architect’s design preferences. In AIM’s Architect’s Brand Preference research, the majority or 62% of architects surveyed indicated that they were involved in selecting and specifying the brand of ceramic tile. This was down from a 2003 study where 90% indicated of architects surveyed indicated they were involved in making brand decisions for ceramic tile.

In addition, of those that were involved, 28% indicated they did not have brand preference. This was a major increase since previous research which indicated only 4% had no brand preference. Could this be that architects do not distinguish the difference of one brand over another? Or, is the choice being delegated to someone in the value chain (i.e., the owner)?

While architects may indicate they have “no preference,” they are, in fact, involved in specifying and recommending ceramic floor tiling. The architect will in fact weigh in on the type of look or performance they want achieve besides functionality.

However, due to the abundance of brand options, architects may delegate the brand selection to “others” in the specification path; such as the interior designer. Many design firms today maintain a list of “approved” brands that have met specific performance and quality requirements. If a manufacturer is not on “the list”, the chance of being in a specification are limited. It is becoming increasingly important for manufacturers to expose and educate architects on their product features, benefits and other services they offer the market.

Becoming a brand on the architect’s preferred list of brands is key to impacting a brand’s position in the specifications. To be on a firm’s list of approved ceramic floor tile providers, a manufacturer needs to provide more than just a quality product. They need to have a history of top performance, offer premiere service and local support for their brand. What can ceramic floor tile manufacturers do to enhance brand selection and preference? How can manufacturers convert “no preference” answers into specifications and recommendations for their brands? These are important questions.

Impacting Brand Specification with the Basis of Design

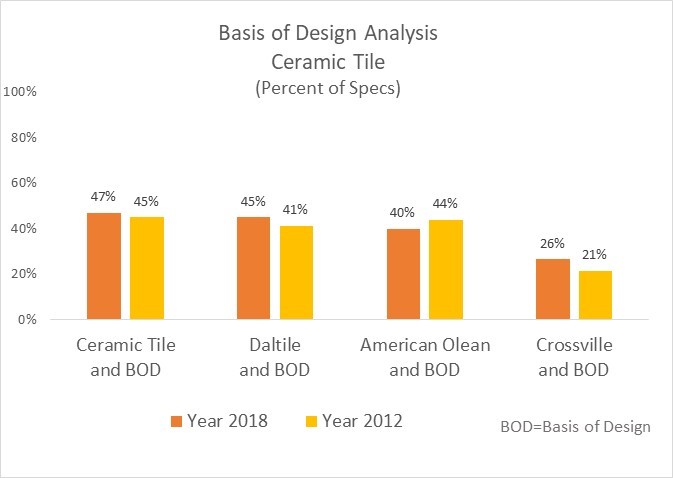

To answer these questions, consider what we know about specifications. The key to gaining ground in specifications is to become part of the “basis of design.”[8] This means that the architect or designer is calling out a specific brand that is used to meet the objectives of the project. To learn more about how often “basis of design” is used in ceramic tile specs, we used ConstructConnect™, (https://www.constructconnect.com/), an online construction database, to get a better sense of how ceramic tiles are specified. By searching the projects ceramic floor tile specifications for “ceramic floor tile with Basis of Design” in specific years, we can see how the specification for “basis of design” and specific brands has changed.

Almost half (47%) of projects in 2018 with a ceramic tile specification also included a brand as the “basis of design.” In fact, this has increased slightly since 2012 where “basis of design” was specified in only 45% of the ceramic floor tile specifications. This analysis also indicates that while just less than half of projects with a ceramic floor tile specification have a “basis of design” spec, there are specific brands that consistently appear as the basis of design[9].

Since there are a variety of different brands that are involved in providing ceramic floor tiles to the market, this type of spec analysis can show manufacturers how often their brand is specified as the “basis of design” and if it has shifted over a specific period of time.

Since the market is constantly changing as new and existing manufacturers introduce new products to the marketing, it is important for a manufacturer to continuously review their position in the project specifications. While a manufacturer cannot always be sure that they are on a firm’s “preferred” list, they can evaluate how often their brand appears in the specifications and measure how often they are the “basis of the design” or appear in the project schedules. If a brand is found in the specifications and is the “basis of design”, they certainly are going to be on the list of “preferred” brands.

Recent analysis of the ceramic tile specs also indicates that in some specs a specific brand can be called out. To avoid being replaced by a “less expensive” ceramic tile or a “comparable” product, tile manufacturers may want to strive to be specified as the brand with “no substitutions”.

The same research can be done on the other product categories or on specific brands based on the manufacturer’s needs. AIM can design a spec analysis to meet a client’s objectives and look at a particular brand/manufacturer, by territory, competitors, project type, location or by spec area/schedule. Let us know where your interests are. Thank you, and let us know what you think!

______________________________________________________________

[1] Facility Executive, February 2017, John McGrath Jr.,” Choose Flooring Wisely”, https://facilityexecutive.com/2017/02/choose-commercial-flooring-wisely/

[2] “How to Align Your Firm with Client Needs” by Michelle Russo, for the AIA Architect, January 6, 2017.

[3] “What End Users Want (from architects and engineers that is), published by Accountability Information Management, Inc. For information on this report, contact: Patty Fleider, patty@a-i-m.com, or call 847-358-8558

[4] Scoring Flooring: Industry Stats for 2018, Posted July 1, 2019: Volume 35. Issue , https://fcnews.net/2019/07/scoring-flooring-industry-stats-for-2018/

[5] Two articles that may be of interest are 2019 Commercial Flooring Trends: Innovation and Design from December, 2018 that discusses this trend as well as others, and reading what maintenance people read to see what they go through in maintaining the choices of architects, such as Trends in Floor Care for Commercial Buidlings, which cites, “Vinyl Composition Tile (VCT): This is the mainstay of commercial flooring, and its updated form, luxury vinyl tile (LVT) is even more popular. A process used in manufacturing makes it even easier to maintain, as it no longer needs on-site application of a topical finish.”

[6]2019 U.S. Houzz Bathroom Trends Study, research conducted in July 2019 of 1,360 homeowners who had remodeled or added a new bathroom in the last 18 months. http://st.hzcdn.com/static/econ/BathroomUSReport2019Final.pdf

[7] The Truth About Specification, by John Schneidawind, AIA highlights key findings on an AIA survey of 330 architects on how they select and specify building materials for commercial projects. The article stresses the importance of an architect’s relationship with building product manufacturers and report that 60% of the time the architect already knows which materials an architect is going to use. https://www.architectmagazine.com/aia-architect/aiafeature/the-truth-about-specification_o

[8]USlegal.com defines it as “Basis of design is a term used in engineering, which typically consists of text paragraphs, preliminary drawings, equipment lists, etc. Well-defined requirements consist of a set of statements that could form the basis of inspection and test acceptance criteria. The basis of design documentation and the specification identify how the design provides the performance and operational requirements of the project and its systems.”

[9] Interestingly, these three companies – Daltile, American Olean and Crossville – were consistently ranked by architects in our brand preference studies as the #1, 2 and 3 choices. Nevertheless, it is a crowded marketplace. What is REALLY interesting is that Sweet’s reference doesn’t list one of these choices among the 11 they do mention. Is it that the companies believe their dominance doesn’t need such listings? Does it create openings for these other 11 that are in Sweet’s? In one specification for a middle school, Landmark Ceramics, a manufacturer of this kind of tile, is the 7th choice of acceptable manufacturers behind two of the leaders, and four others. However, they only have three of the projects in the planning stage projects we pulled at this writing, so they have their work cut out for them to convince architects and designers of their preference! Yet the fact they are in the space is a large part of the battle. Leaders in the marketplace are hard to displace, but the way people communicate these days makes it easier than in the past. For a discussion, contact us.