How to Penetrate the Commercial Wall-Hung Vanities Market

Tapping the true potential for any market is part science, part art. In the end, the decision on a go/no-go decision into a market rests on the accuracy of calculations of market size and overall business potential.

Tapping the true potential for any market is part science, part art. In the end, the decision on a go/no-go decision into a market rests on the accuracy of calculations of market size and overall business potential.

The real essence of a market strategy for a product manufacturer deciding to enter a market, however, is answering four questions:

- How big is the market you are entering?

- How many products do you want to sell into that market?

- Are you going to take away buyers of other products for yours or create new buyers?

- How and where are you going to sell products?

The fourth question can actually shape the first three questions. For example, if you decide to sell direct in a two-step distribution market, your market size may expand or contract accordingly. Or, if you have an established two-step distribution base, will filling it with your new product eat into your other product sales?

This fourth question has grown in importance over the years because of technology and the Internet. The evidence is any market you examine today: established brands are being overturned, pushed aside and threatened by other brands simply because of the way they go to a market.

Strategy Becomes Increasingly Complex

Unless you have a well planned and executed market strategy – one based on facts not fiction – you are not likely to succeed for long in this disruptive environment. As markets become more complex than manufacturers care to admit, so does the strategy to penetrate them (see a blog on this topic, Who’s On First when it Comes to Strategy).

Success is often the result of inertia that has been built up over the years. People, being people, think that things will also go on like before because of that inertia.

You have only to review business today to see this argument falls flat (i.e., mergers, acquisitions, new competitors change the landscape quickly, and no amount of money or effort can sustain and prevent market upheaval).

A general rule, then, is that any established market a manufacturer may want to enter has leaders and followers already in it (unless of course you are creating a new market). That is, there are established brands and secondary brands. Lately, because of technology and the Internet, there are what we call “interloper brands” that disrupt a market. These are brands that seem to come out of nowhere and establish a base within a market, surprising both the established and secondary brands.

Wall-Hung Vanities are No Different

According to Grand View Research, the global bathroom vanities market size was valued at USD 7.5 billion in 2018 and is expected to expand at a CAGR of 5.9% from 2019 to 2025. Those are “nice to know” stats, but what’s really behind them to help you match a successful strategy?

The first thing you find when examining that market is the rampant confusion of just what a wall-hung vanity really is. It’s always important to “define your terms” and using research results like the above is no different.

As a matter of fact, with all specifications, the main obstacle is language. Is a vanity a sink? A fixture? A cabinet? Just deciding on one of those definitions will impact your efforts if you decide incorrectly. And examining the 400,000+ specifications available in the construction market today via the ConstructConnect™ database to help you determine the answer is time and cost prohibitive unless you have a clear understanding and definition of your search terms.

Yet, if you are determined to penetrate the commercial wall-hung vanity marketplace, your strategy must include reaching the professionals who write these specifications: the architect or owner channels. This means contacts. This means having a sales force capable of making such calls on these professionals. This means implementing a concentrated marketing effort in order to tip the scales in your favor by having you listed or designated as “an alternative” in what may be a very crowded marketplace. This means, in short, you have to exert time and effort to find out the truth.

The Fourth Question

The fourth question we suggested – how are you going to sell your products – is essentially the determining factor in hatching your marketing strategy for wall-hung vanities. If you Google the term, you’ll find millions of pages all offering such products through a variety of channels. How do you expect to stand out or will you become just another vanity on the Google Wall? What is going to be your true differentiation and will it be strong enough and important enough to your customer and potential customers?

Should you consider a retail strategy? A showroom strategy? Both? What about selling direct? How will your strategy to reach the consumer market differ from reaching the commercial market?

If you want to sell a lot of these products in a single swoop, commercial specification is the way to proceed. But, getting specified isn’t easy. This is the “road less traveled by,” but it makes all the difference.

Besides, regardless of the road you take, it will be crowded with competitors. Therefore, differentiation will be one of the real keys to success. Your wall-hung vanity MUST differentiate to be purchased or specified.

Your market position as you aim for specifications is always divided into those brands that dominate a specification and the other brands that want to dominate. Sometimes, “basis of design” is important. Therefore, your strategy for the commercial market always begins with a specification analysis.

In the case of wall-hung vanities, a curious thing occurs when you do that: unlike other markets, there is no dominant brand. In fact, the specification market for wall-hung vanities is virtually devoid of brands – making it wide open territory for a manufacturer who wants to penetrate and dominate it.

Of course the wall-hung vanity will compete with other sink/vanity options in the commercial market. Typically, in the current specification mode, the decision on what wall-hung vanity to use is left to the contractor. Is that where you want to play?

Many Start, Few Finish

Before we get too excited, it is important to face the realities of discovering the right strategy.

There is a reason no brand dominates wall-hung vanities: it is partially because it may be considered a commodity product.

Fighting your way out of a commodity world is extremely difficult and costly, and so many companies in examining the risks, take a different path. That is, they produce a “me too” product and hope by entering established channels they can at least get something.

Or, like many manufacturers today, they let their brand be dragged into the commodity world unknowingly by believing that the world doesn’t change. This gives the “interlopers” an open ticket to disrupt.

But, if you have true differentiation, you actually can succeed in breaking through even in a commodity market. However, you have to put your differentiation (either product or service differentiation) in front of the people who matter: the architects and owners who make or influence the purchase decision.

Many manufacturers turn to specialized rep organizations to help with these efforts. While these companies do what they advertise, they do so on behalf of all the lines they carry. The weight they give your product during the presentation to the architects and owners – the knowledge they bring to the table – is only as good as you, the manufacturer, trained them to have. Or as the other manufacturers have given them.

Will they fight for your specification? Do they know enough to dismantle the existing specification with benefits of your product or at least put doubt in the mind of the owner or architect – if they can get in front of them to begin with?

Targeted Market Exposure Used to be Easy

In the old days, the manufacturer would run an ad in one of the five architectural or four owner publications that existed, leads would come in and salesmen would call. Many manufacturers who followed this pattern built strong market shares. Prior to the disruptive environment that exists today, these were the major brands found in the specifications.

But, times change. Today, people are getting information from all sorts of channels – not just the media outlets. In fact, the five architectural publications have become three and owner publications are quickly disappearing, suffering like all print publications from the onslaught of digital information.

However, established brands in markets are not invulnerable. They, like secondary or interloper brands, have to fight in order to maintain their position. In fact, in a recent AIM research report , we found that the leading product manufacturer who for years dominated the specifications for a specific product suddenly dropped to the number two preference. In other words, the dominant brand was no longer dominant in the specification arena. Anything is possible.

How Does this Change Happen?

Effort. Targeting the right architects and owner organizations repeatedly with information, presentations and education. It’s not cheap or easy, but in the long term, that is the only way to topple existing specifications and gain traction in the commercial market.

In fact, that is the only way to maintain the existing specification by leaders. The dirty secret of digital communications is that there is never enough. The thirst for more data can’t be satisfied (see the Blog, how much data can you eat?).

Often, however, leaders become complacent. That complacency is your opportunity to begin your campaign.

Wall-Hung Vanities Spell Opportunity

This category of product seems to be wide open for someone to come in and dominate the category. In the past two years, for example, only 133 projects in the ConstructConnect™ Insight database had “Wall-Hung vanity” in the specific specification, and within those, no one manufacturer dominated. In fact, more than not, that was an open specification – left to the contractor or owner to “fill out.”

In today’s current commercial construction environment, there are 105 active projects with “Wall-Hung vanity” in the specifications, and the absence of a dominant player still exists. Therefore, if you are a manufacturer of Wall-Hung vanities and want to dominate this category, you have to start with these 105 projects.

The market valuation for these projects is $1.7B. That’s a lot of potential for wall-hung vanities, and even more if you can dominate the specification.

Where do You Start?

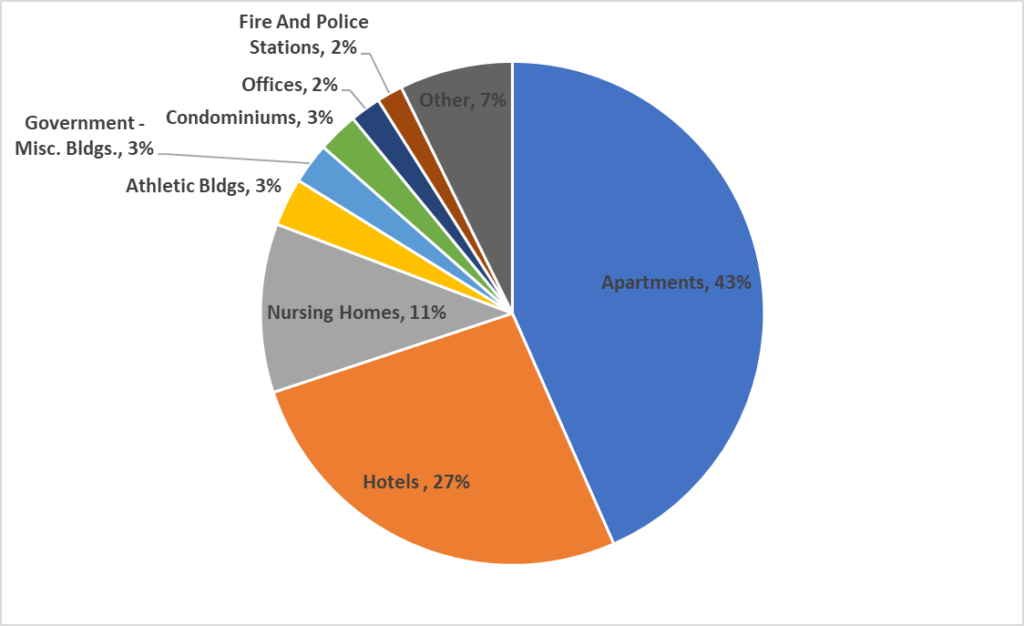

There are 25 different types of commercial projects for wall-hung vanities in our group of 105 projects, but only three of these markets comprise 81% of the total share: Apartments, Hotels and Nursing Homes. If someone tried to convince you that government buildings or medical offices are the key markets for your vanities, your aim would be considerably off. It isn’t that government or medical aren’t markets: your potential would be only 4% or so of the available markets for Wall-Hung vanities. Where would you rather hunt?

Architects with Influence

There are ten architects that control over 50% of the projects that involve wall-hung vanities in our grouping. Four of those ten are involved in the top-valued projects. Here is the list (the top four are among them) for your review:

- Leddy Maytum Stacy Architects (LMS)

- Martin Riley Associates Architects, P.C.

- IBI Group

- Architectural Concepts Inc.

- FRCH Design Worldwide – Cincinnati

- WATG

- Gorman & Company, Inc

- Cornerstone Design Architects- Ann Arbor

- Bargmann Hendrie + Archetype (BH+A)

- Bessolo Design Group Inc

How do you tell which are the top four? Through specification analysis! Or, is it better to aim at all ten?

Often, not a single architect or small group will control an end user client like a hotel chain.

For example, AVID™ hotels is part of the IHG group of properties. Avid™ hotels is IHG’s newest brand. In this group of products with wall-hung vanities, there are 18 projects going on – and not all by the same architect. This is not uncommon when the owner holds the key decisions on what goes into the rooms. Here is a list of those architects for your reference.

- ADR Designs

- AP Architecture Inc.

- B&A Architecture

- Carlson Design Team

- Craig A. Otto Architect Inc.

- Dale Sweeney Designs

- Design 360 Architects

- FORM Architectural Group

- HRH Architects, Inc.

- Indigo Design

- Jerry Herndon Architect

- Leonard Design

- Leung Architects

- Maust Architectural Services Inc.

- Overcash Demmitt Architects

- Pure Design

- RSS Architects

- Union3Studio, Inc.

But, in many cases you might be better off contacting the IHG group directly. Often with large hotel chains they have a pre-approved list of manufacturers for fixtures and fittings or a standard spec that cannot be revised by the architect. If your brand is not on the approved list, your brand will not appear in the specification.

This is just the beginning of the type of analysis that will help you hatch your strategy for successful penetration of the commercial and residential wall-hung vanity market or any product in a market. For more information including more lists, strategies and discussion, please call us. We’re here to help.