Prison Break! How to Use Data to Tap the Prison Market

One of the things that happens when you actually take the time to study and not skim reports is you formulate questions that need answering.

In the latest report from a great data construction firm, ConstructConnect™, Prisons as a category was listed as -39% year over year in terms of construction movement. And yet, prisons as a category in the same report later on in a table is reporting Prisons +1124.7% year over year.

Can both be true?

A closer look seems to suggest that the -39% refers to year-over-year change in September 2025 project counts (i.e., how many prison projects entered planning that month vs. the same month a year ago). The +1,124.7% reflects the year-over-year change in total project dollar volume (not project count) for all prison-related construction projects year-to-date through September.

So both ARE true.

But that makes it confusing, doesn’t it?

The numbers suggest a small number of very large prison projects entered the pipeline in 2025, but in September, fewer new prison projects were initiated compared to Sept. 2024.

My question is, then, so what?

Or should I say, who cares?

What is important to know is that if prisons are your target, there are identifiable architects and engineers doing that work, REGARDLESS OF WHAT THESE NUMBERS SUGGEST.

So the real question is: do you go after the people controlling the projects, or settle for knowing some of the numbers for your dashboard you may be building in a category?

So the real question is: do you go after the people controlling the projects, or settle for knowing some of the numbers for your dashboard you may be building in a category?

Lock Them Up

Relationship building takes time. You can’t get on a spec with one sales call, or one email blast. To reach your target audiences, integrated campaigns demonstrating unique knowledge has been and always will be the key to successful sales.

We took a look at prisons to provide you some techniques to shape your communications if that is your market. If prisons are not your market, the same techniques can be applied to ANY category you are aiming at. Because the point is, we’re after relationships not numbers.

Step One: Create a Dataset.

Step One: Create a Dataset.

Using platforms like ConstructConnect gives you tremendous first-look access to any category to begin building relationships. The dataset we created for this exercise involving prisons looks like this for the planning stage of prison projects:

- Total Projects Listed: 574

- Architects serving these projects: 96

- Engineers serving these projects: 75

As mentioned, we’re after the people BEHIND the projects.

Step Two: Identify the firms where the people are.

These numbers confirm that the top 10 firms building prisons (only a subset of a much larger pool of participants across the dataset) are in the table below. We have to start somewhere!

| Rank | Architect Firms |

| 1 | GHD – Syracuse |

| 2 | Moseley Architects – Raleigh |

| 3 | Pond & Company |

| 4 | Spring Line Design Architecture + Structural Engineering |

| 5 | Parkhill – Lubbock (HQ) |

| 6 | LRS Architects, Inc. – Portland |

| 7 | Jay Ammon Architects, Inc. |

| 8 | BCA Architects Engineers – Watertown |

| 9 | HOK – Dallas |

| 10 | DLR Group – Denver |

| Rank | Engineering Firms |

| 1 | GHD – Syracuse |

| 2 | Cabezas Engineering, PLLC |

| 3 | Thompson Consulting Engineers |

| 4 | Sud Associates P.A. – Durham |

| 5 | E2 Engineering |

| 6 | McKim & Creed / Raleigh |

| 7 | Bouthillette Parizeau et associés (BPA) – Montreal |

| 8 | Steen Engineering Inc. |

| 9 | New York State Office of General Services (NYSOGS) – Design & Construction |

| 10 | CIMA+ – Longueuil |

Step Three:

Where are these projects with these firms located?

By dollar volume, here is where those projects are being built in the top ten states.

- New York

- South Dakota

- Washington DC

- Tennessee

- Ontario

- Hawaii

- Arkansas

- Georgia

- Colorado

- Kentucky

But by number of prisons, here are the states where the projects are being built:

- California

- Texas

- North Carolina

- New York

- Florida

- Ohio

- Louisiana

- Georgia

- New Jersey

- Washington

Step Four: Average Per Project

Step Four: Average Per Project

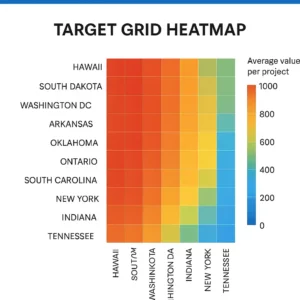

While you can now begin building relationships by firms based on the states in either volume or number of projects, a better way is to get the average cost per project in those states. When you do that, your target grid looks like this for prisons:

| State | # of Projects | Average / project |

| Hawaii | 1 | 1,000,000,000 |

| South Dakota | 3 | 522,000,000 |

| Washington DC | 6 | 231,519,751 |

| Arkansas | 5 | 168,873,291 |

| Oklahoma | 2 | 144,750,000 |

| Ontario | 8 | 126,433,625 |

| South Carolina | 5 | 104,612,000 |

| New York | 34 | 98,208,819 |

| Indiana | 2 | 96,900,000 |

| Tennessee | 13 | 95,921,754 |

As much as we’d all like to fly to Hawaii to start a relationship with the BIG ONE, you’re better off doing the numbers game. Aiming at New York with 34 projects (even though the average per project is lower than almost all of them) gives us more targets to shoot at. And more targets, more chances to start and build a relationship.

Step Five: Focus

Looking strictly at New York, here are the architectural firms doing the work:

- Azar Design Co – Albany

- BCA Architects Engineers – Troy

- BCA Architects Engineers – Watertown

- GHD – Syracuse

- HOLT Architects – Ithaca (HQ)

- SMRT Architects & Engineers – Schenectady

- Spring Line Design Architecture + Structural Engineering

- Trautman Associates

- Urbahn Architects – New York

GHD – Syracuse is a huge architectural AND engineering company. With some investigative reporting on LinkedIn, you will find Kyle Morris, AIA, NCARB who is the Senior Architect at GHD doing the work. For variety, let’s also aim at South Dakota as well. In that state, only one firm is doing the work – nelson worldwide, LLC — and if we do some detective work with LinkedIn, we’ll find Meghan Vincent, AIA, NCARB is the one doing it.

Step Six: Attack!

The final step is to hatch your marketing and sales strategy. Emails, phone calls, CEUs, PR, Case Studies with your product, everything is on the table for review. You might find my blog Should I Sell to a Group or an Individual? helpful in planning your strategy.

So what are you waiting for?

So what are you waiting for?

Most prison construction projects are bid on using either a traditional design-bid-build or a more modern design-build process, based on highly detailed specifications provided by the government. Bidders must demonstrate they can meet strict security, performance, and budgetary requirements.

In the same way, your attack strategy should follow the guidelines that are used when responding to the specifications themselves.

Master the target: Your communications plan must meticulously review all provided documents, backgrounds, design philosophies and how your product fits in.

- Calculate highly detailed analysis: Your attack plan must always include the cost savings, performance efficiencies, etc. that your product brings to the table. This is especially true in the prison market, where detention-grade materials, advanced security systems, and robust construction techniques are used.

- Demonstrate experience: Your communications should be competitive and transparent, and show the target why you are the best provider, which often includes a review of past performances.

- Show financial stability: Your communications should demonstrate your financial capacity to handle the project and background.

Like I said: what are you waiting for? Let us know how we can help, and good hunting! Contact jim@interlinegroup.com for information on this report.