How Architects Specify Acoustical Ceiling Products

In order for manufacturers to get their product specified, they must begin to understand more about how architects or designers select and specify products. Learning how the specification process works can help a manufacturer provide the architects and specifiers with the key information they need to get their brand in the building specifications, or better yet, get the product purchased.

In order for manufacturers to get their product specified, they must begin to understand more about how architects or designers select and specify products. Learning how the specification process works can help a manufacturer provide the architects and specifiers with the key information they need to get their brand in the building specifications, or better yet, get the product purchased.

According to a recent research study conducted by Dodge Data & Analytics[1], “Exploding 9 Myths How Architects & Contractors Really Select Building Products,” more than 50% of architects indicated they pre-selected less than half of all the products they intended to use before the building is started.

This is not surprising. In our own proprietary research, depending on the category, the architect will pre-select anywhere between 10% to over 70% of products for a building. In security and fire protection, the architect almost is never involved in specification of specific products, delegating it to a consultant/developer or other non-manufacturer over 65% of the time. Whereas in Siding Materials, the architect has selected brands 90% of the time for his or her specification.

Even when the architect does the pre-selection, is it never one brand. Rather, it is a “list” of brands, with one being perhaps the “Basis of Design.” This way, the architect allows the contractor and owner to be the deciders.

In addition, the Dodge research showed that contractors are successful in getting architects to accept an alternative brand than originally specified 50% of the time! The words “or equal” allow this, and those words have plagued manufacturers for decades. “Or equal” opens the specification door to manufacturers, including even those not on the original specification.

At the same time, those doors also allow a manufacturer the opportunity to introduce and educate designers on the features and benefits of their product and why it is in he specification to begin with, or can be used as “or equal.”

Specification is a Complex Game

With the abundance of information available on the internet, manufacturers often make the mistake of assuming architects know all they need to know about their product or at least can easily find it. But, architects often say they find manufacturers websites hard to navigate and don’t always provide the specific technical information they need to make the best product selections for their projects.

Besides, architects tend to specify products they have used before and are the most familiar with—so the more information and technical information a manufacturer can provide the better.

In fact, today most architects and architectural firms have “standard” specifications and often maintain a list of “pre-approved” products that meet their standards. While it may be difficult to be included on a list of approved products, it is not impossible. Most lists are reviewed on an annual basis and architects love to learn and explore new products.

Continuing Education

CEUs are one of the primary ways of educating designers and getting on the short list. The IDCEC for example lists over 2,300 courses available to architects and interior designers. You can download their list in

Excel® here. Only 3% lof the courses on that list deal with ceilings. Only 1% deal with “acoustical.” AIA itself is in the process or redesigning its website but boasts over 75,000 approved classes. How many deal with acoustical ceiling products is anyone’s guess.

The AIA does have a place where you can view state-by-state requirements. Simply pick your state and the website will deliver the result of requirements. Manufacturers find this CEU channel a convenient way to deliver their content and expose the architect and designer to the products. Our sister company, Interline Creative Group, Inc., is an AIA Provider, and if you’re interested, can help you through the administration and creation of such courses.

The point is that to even be considered for a pre-approved list, manufacturers need to be able to demonstrate the successful use their product and provide some assurance of long-term quality and performance. This is often done in CEUs and through case studies.

Acoustical Ceiling Products

When it comes to acoustical ceiling products an architect has many brand options. Sweets, which is one of the building product sources for the design and construction professional, lists 2800 Products when searching for the term “acoustical ceiling products.” That’s a lot of products! But, those products came from only 23 manufacturers!

Where it used to be enough to be a part of a firm’s “short list,” today it is even better to be named as the “Basis of Design” or ultimately be listed as the brand with no substitutions. This means the contractor has little or no ability to change the product specification without a lot of work.

Spec analysis conducted by Accountability Information Management, Inc. (AIM) indicates that “most” product specifications list a brand(s) or “equal.” In fact, on average, a product specification can list 5 or 6 “equal” brands. This gives the contractor many options when it comes to the actual purchase and use of a specific brand. A Basis of Design specification simply places an additional limiting factor on the ability to change a product out of the spec.

Evaluating Designers Involvement Is Key

To help manufacturers evaluate their brand position in the marketplace, it is important to first understand more about an architect’s own level of involvement when specifying acoustical ceiling products. As pointed out earlier, it can vary greatly depending on the product category.

How much control or influence does the architect or designer have on selecting a particular brand of acoustical ceiling tile?

Today, architects and designers often need to balance the project budget with specific design goals; but, other factors like the type of project, the location of the product within the facility or the need for specific sound control could impact the acoustical ceiling decisions. And like the other products the architect specifies, involvement with acoustical ceiling products will vary.

For example, in restaurant or public facility with many occupants, the type or brand of acoustical ceiling may be influenced by a specific need to limit the escalation of sound at particular peak periods. Or a need to meet a certain look or design can control the product selection.

Brand Preference

A comprehensive Accountability Information Management, Inc. (AIM) Architects’ Brand Preference Study revealed that the acoustical ceiling market is very competitive. In that study (which was open-ended brand recall brand preference where the architect had to write in the answer without the use of a pre-determined list), there were 17 brands mentioned, five less than there were in Sweets! Armstrong was the most often preferred brand followed by USG and Certainteed. CertainTeed® is a brand of exterior and interior building products and a subsidiary of Saint-Gobain, one of the world’s largest and oldest building products companies. But specifications carry brand names for a long time (see footnote 3).

While there were 17 brands mentioned by architects for Acoustical Ceiling products in that study, the top three players represented the majority of the acoustical ceiling brands. It is interesting to note, too, that 7% of the architects in our study relegated that choice to the interior designer, project manager, or general contractor (see previous discussion on pre-selection). Although a list of specific brands will no doubt shift over time, there are still numerous brand choices when it comes to acoustical ceiling products. More important, those brands tend to stay in the specifications once they are in for quite awhile!

In AIM’s Architect’s Brand Preference research, only 18% of the architects surveyed indicated that they were not involved in selecting and specifying the brand of acoustical ceiling products. In addition, 11% indicated they did not have any type of brand preference—an increase from 4 % with “no preference” from a previous study. While architects may indicate they have “no preference,” they are, in fact, involved in specifying and recommending acoustical ceiling products to a high degree, making the category competitive. However, due to the complexity of commercial projects, architects may delegate the brand selection to the interior designer or “others” in the specification path as noted earlier.

Brand Spec Analysis Help Manufacturers Get Specified

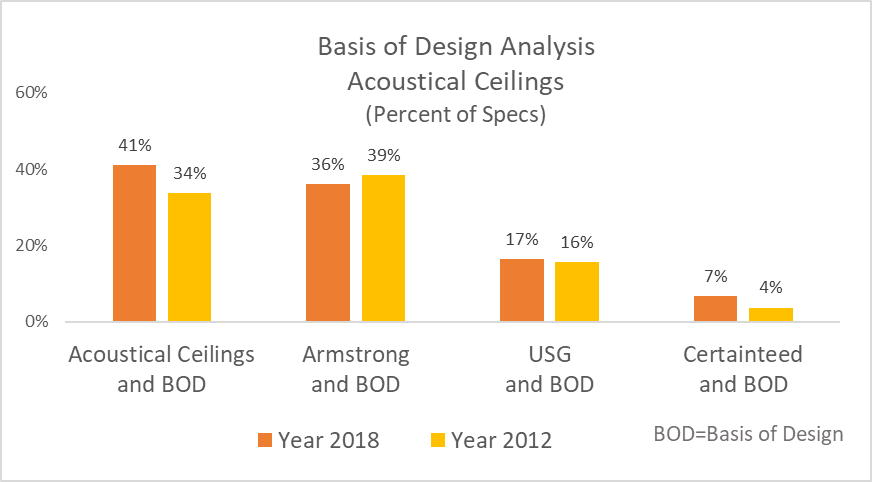

The key to gaining ground in specifications is to become part of the “Basis of Design.”[2] This means that the architect or designer is calling out a specific brand used to meet the objectives of the project. To learn more about how often “basis of design” is used in acoustical ceiling specs, AIM used ConstructConnect™, (https://www.constructconnect.com/), an online construction database. By searching the projects with acoustical ceiling specifications for “acoustical ceiling with Basis of Design,” in specific years, we can see how the specification for “basis of design” and specific brands has changed.

41% of projects in 2018 with an acoustical ceiling specification also included a brand as the “basis of design.” This was an increase since 2012 where “basis of design” was specified in only 34% of the acoustical lighting specifications.

Since there are many brands that are involved in delivering acoustical ceiling products to the market, this type of spec analysis can show manufacturers how often their brand is specified as the “basis of design” and if it has shifted over a specific period of time. The analysis also has the potential to help manufacturer target both architects who are specifying their brand, and those that are not. It is very powerful analysis that can, over time, shape the short list in an architect’s firm.

The market is constantly changing, and the way architects write specifications can also change. In fact, AIM’s spec analysis for acoustical ceiling brands indicated that many times, the basis-of-design manufacturer was not even listed in the specification but indicated the information was located on the drawings. This is another way manufacturers can solidify contractors’ purchase and use their brand in a particular commercial project.

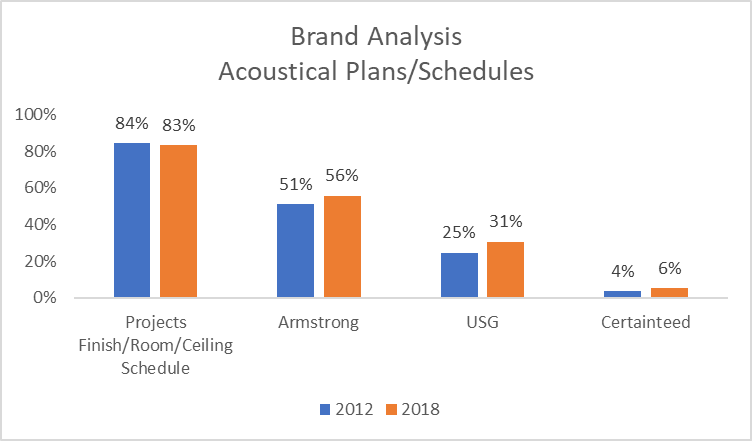

Looking closer at the schedules and plans for the acoustical ceiling products, AIM found that 84% of the projects with acoustical ceiling products also had a finish or ceiling schedule.

In addition, specific “brands” like Armstrong and USG appeared the majority of the times in these schedules.

Specification analysis can assist manufacturers in better measuring their position with architects/designers in the market, and increase the likelihood that the contractor will actually purchase the brand specified[3].

This type of analysis can also become fairly complex when brand names are abbreviated or a particular product number or product line is used rather than the manufacturer’s brand name.

Bottom Line

It is important for a manufacturer to continuously review their position in architect’s specifications and plans. While a manufacturer cannot always be sure that they are on a firm’s “preferred” list, they can evaluate how often their brand appears in the specifications, measure how often they are the “basis of the design” or evaluate how and when they appear in the finish/ceiling schedule. If a brand is found in the specifications and certainly is the “basis of design” they are going to be on the list of “preferred” brands.

The same research can be done on the other product categories or on specific brands based on the manufacturer’s needs. AIM can design a spec analysis to meet a client’s objectives and look at a particular brand/manufacturer, by territory, competitors, project type, location or by spec area/schedule. Let us know where your interests are. Thank you.

______________________

[1] Exploding 9 Myths How Architects & Contractors Really Select Building Products conducted by Dodge Data & Analytics surveyed 170 architects, 150 contractors and 99 manufacturers to learn more about their views on product specification. https://www.construction.com/toolkit/guides/Exploding-9-Myths

[2]USlegal.com defines it as “Basis of design is a term used in engineering, which typically consists of text paragraphs, preliminary drawings, equipment lists, etc. Well-defined requirements consist of a set of statements that could form the basis of inspection and test acceptance criteria. The basis of design documentation and the specification identify how the design provides the performance and operational requirements of the project and its systems.”

[3] For example, in the current database of over 500,000 projects, there are about 9% that specify “acoustical ceilings.” From that group, Armstrong has 39% written into the specification, USG 41%, Certainteed 29%, National Gypsum 29% and Chicago Metallic 18%. But there are least five other manufacturers from the AIM brand preference study in those specifications that comprise 27% of the written specifications within that grouping! As we suggest, it’s complex.