How to Investigate the Architect Industrial Market

This is part of a comprehensive report seeking to help industrial construction marketers create a much-needed new playbook to do just that with their brands in an ever-increasing competitive landscape. For more information, including the complete report, contact: info@a-i-m.com. _______________________________________________________________________________________________________________________________________

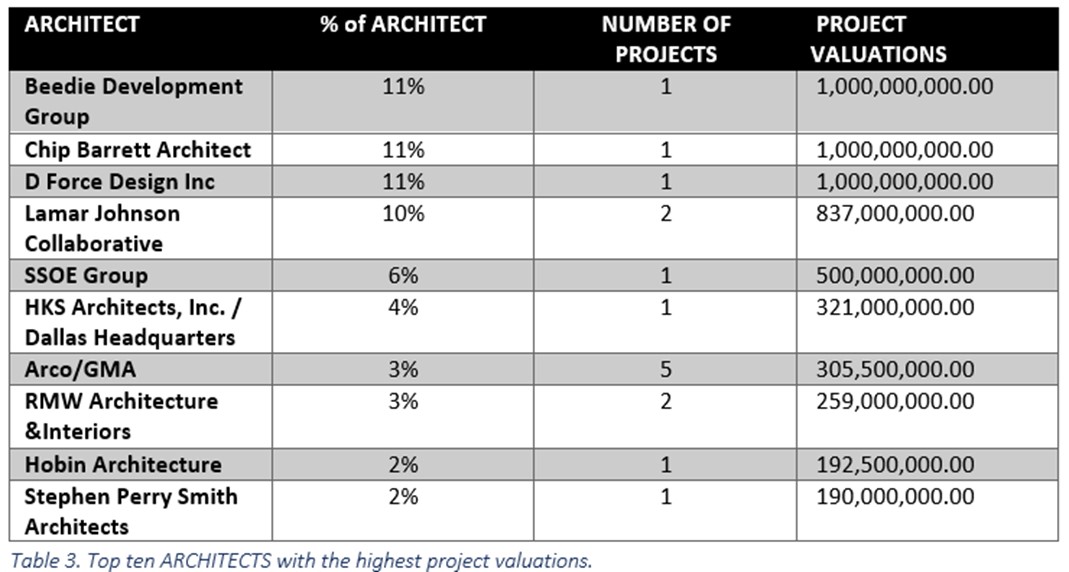

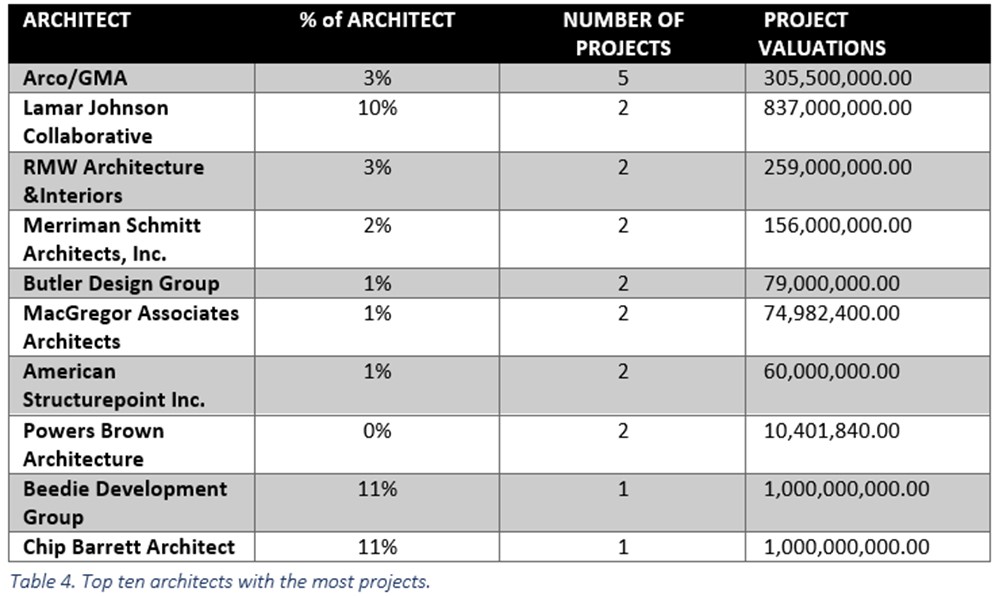

Architects are another important group to pursue in your new play book for the industrial construction market. Here are the two tables similar to the owner tables, but with architects to begin your investigations.

Four architects appear on all two lists:

- Beedie Development Group

- Chip Barrett Architect

- Lamar Johnson Collaborative

- RMW Architecture &Interiors

Beedie seem to be interesting because they are also on the General Contractor and Developer lists you will see later in this report, suggesting this might be a corporate account pursuit as discussed with owners.

In fact, each of these four companies have websites worth examining, providing not only contacts to begin your relationships, but projects that they are working on now.

In fact, each of these four companies have websites worth examining, providing not only contacts to begin your relationships, but projects that they are working on now.

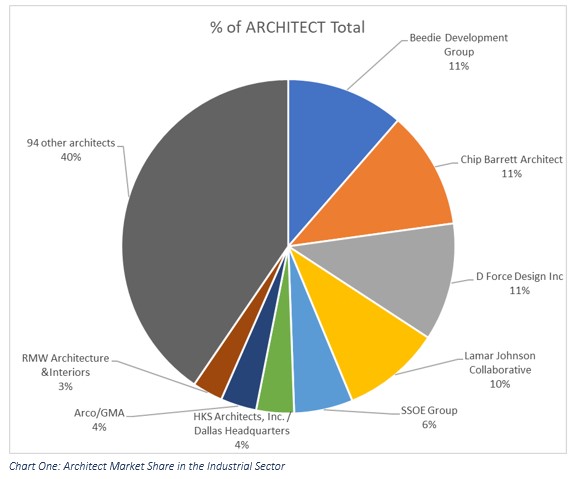

What you can see on Chart One when we examine the potential relationships with architects in this dataset (remember, it’s planning projects in the industrial sector) is the share of the leads in the dataset (% of architect). This will allow you to make judgments about potentials and which to pursue.

You will find through examination that architects work on other than industrial projects in many cases, and that some will do more than others in that regard. Only through careful analysis will you be able to segment precise targets that focus on industrial (or any other category for that matter).

You will find through examination that architects work on other than industrial projects in many cases, and that some will do more than others in that regard. Only through careful analysis will you be able to segment precise targets that focus on industrial (or any other category for that matter).

Let the Architect Investigation Begin

You can follow the same method outlined in the Owner investigation, developing “key account” strategies for architects. Here is another way to approach analysis of a market.

There are often lists to reference in any category, owners, architects, etc. Sometimes you may want to begin an investigation using such a list as a “take off” point.

If you google the best in industrial buildings design, you’ll see 70 Industrial Sector Architecture Firms for 2019 (after COVID, the market turned upside down but this is as good as any place to begin). We only found four from our dataset list that matched this “top” list, but that doesn’t account for the mergers or other devastating effects of COVID-19 on architectural firms (Three firm leaders share how the COVID-19 pandemic has affected business By Steve Cimino is an AIA piece you might find interesting on how COVID affect the profession. In another AIA piece, it was noted that the most recent data for architectural services points to 13,600 fewer positions below the pre-pandemic peak of 200,000 in February. Recent AIA research indicates that 60 percent (or about 8,160) of those lost positions were architecture staff, or equal to about 6.4 percent of the total number of licensed architects in the US, which reached a pre-pandemic peak of 126,130. Found in Reading between the trend lines, by William Richards.)

Here are the four that matched the top firms in 2019.

- ATA Beilharz Architects

- MacGregor Associates Architects

- Nelson – Atlanta

- Ware Malcomb

But remember, lists are compiled by people, and people have opinions. Another list might produce additional matches to our own tables. The point of the exercise is to narrow your focus to architects you believe will benefit from forming a relationship with your company based on the products or services you offer.

But remember, lists are compiled by people, and people have opinions. Another list might produce additional matches to our own tables. The point of the exercise is to narrow your focus to architects you believe will benefit from forming a relationship with your company based on the products or services you offer.

There are two architects listed for the AMAZON projects in the dataset we are using in this investigation: MG2 and Nelson – Atlanta.

MG2 operates from six locations throughout the United States, and a study of their projects includes Home Depot and Costco besides Amazon, as well as many other warehouses or what’s termed “warespace.” It is always important to familiarize yourself with what a company is working on before you seek out the people working on the projects.

MG2 is also working on LiDL which established U.S. headquarters in Arlington, Virginia in June 2015. Today, there are more than 150 Lidl stores across the East Coast. And it looks like MB2 built of lot of them!

Of course, MG2 is not the only architect doing business in the industrial construction market as we have shown. However, looking at all the firms in our dataset gives us clues on who else to target if we are seeking architects. Developing relationships with many of these firms is important!

For example, MG2 has done a lot of LiDL work. But when we look at LiDL itself, we discover other architects like McMillan Pazdan Smith Architecture – Greenville who did eight of the LiDL stores, as well as other retail projects. You may want to put McMillan on your pursuit list! This is an example of how detours work: you add to your targets by logically pursuing the central question: of the thousands of architects, which ones should my company pursue?

The point of an investigation is that RESEARCH is needed to develop your target list to build and maintain your own brand in a relationship with that firm.

Architects have “short lists” and your brand needs to on them. You can’t get on the lists unless you form the relationship. You have to displace brands that are on the lists with your own, or at least “share” the list!

In many cases, corporations like LiDL behave like others (i.e., WalMart) and have their own proprietary specifications but will empower the architects they employ with the authority to substitute based on local conditions or other factors known to the architect. In other words, they don’t just execute. They execute with thoughtfulness.

For example, if you examine an LiDL specification, you might not find any brands listed. They seem to be mostly “generic” specifications in that they do not mention specific brands of products, leaving the door wide open for a manufacturer to develop the relationship and get his brand specified.

Yet as we said, that takes time, and how many people will take that time to begin the process in this age of “just let me click.”

You can select from one of the top architects in Chart One, or from the 94 others who are the large part of the pie. If you have your own list of architects already – and they are not on these lists – perhaps you are hunting in the wrong area.

Do a pro forma on your list to see how many industrial buildings they are building.

Or, do analysis on any of these architects and then “reverse engineer” their projects to see where the opportunities are hiding.

We randomly selected RLC Architects, one of the 94 “other” architects in Chart One to show you as our example of an investigation of a firm.