How to Reach Owners in the Industrial Construction Market

This is part of a comprehensive report seeking to help industrial construction marketers create a much-needed new playbook to do just that with their brands in an ever-increasing competitive landscape. For more information, including the complete report, contact: info@a-i-m.com. _______________________________________________________________________________________________________________________________________

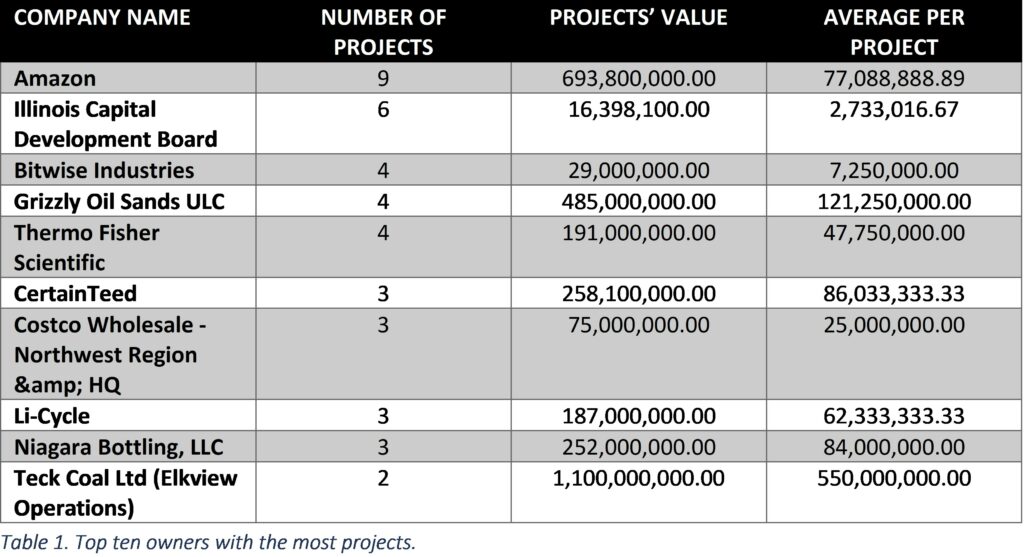

There were 996 “owners” of industrial projects in the dataset we examined. Sorting our file in three ways produced some “playbook pictures” we can look at to help us shape a contact strategy. First, the owners with the most projects in Table 1.

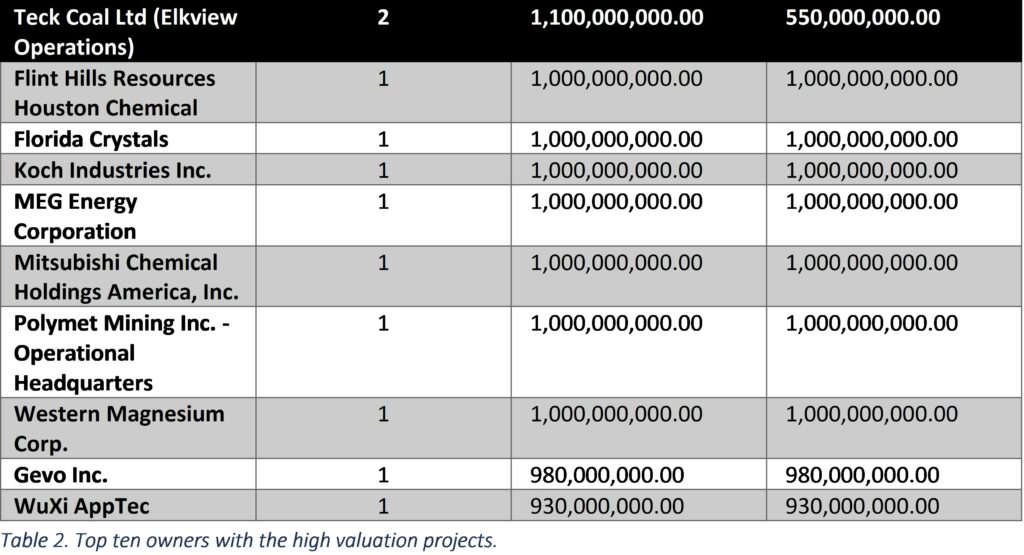

But having more projects doesn’t mean the highest in valuations, as shown in Table 2. Note that except for Teck Coal Ltd, none of the companies are the same in the two tables.

So the first question to ask in writing your new playbook is do you chase quantity of projects or a project’s price. How likely are you to penetrate the billion-dollar project?

Robert Browning’s “A man’s reach should exceed his grasp, or what’s heaven for?” quote comes to mind, but so does Freud: “All who wish to reach a higher standard than their constitution will allow fall victims to neurosis. It would have been better for them if they could have remained less ‘perfect.’” Nevertheless, your calculations must take these factors into account.

Table 2 helps explain what we mean by “classification” nuances. The Florida Crystals project, for example, is stalled, with no movement anticipated until 2024. The City of South Bay has chosen not to move forward with land acquisition and site access. Neither an architect nor a general contractor has been chosen. Should this project even be counted in the analysis? Should it even stay “on the books” of the database that produced it?

In all cases, the ultimate question becomes which Table to pursue in your playbook?

The answer may seem obvious – Table 1. These owners have more than one project going on, thereby increasing your odds of making it on to the short list. But that may not always be the case. Only careful analysis of the people behind the projects will help you determine how to write your playbook. This is why it is important not to chase projects – but to write your playbook to pursue PEOPLE – the people behind the projects.

In addition, your own products will determine your final decision. That is, which of your products are better suited for a specific owner or type of building? Or architect…or contractor?

These are the types of decisions you have to make when rewriting your playbook, because the database provider only “reports” what he believes are active or inactive data. It’s up to you to do the hard work of investigation.